Terrorist Financing Is Often Referred To As "reverse Money Laundering.

The idea of cash laundering is very important to be understood for those working in the monetary sector. It is a course of by which dirty money is transformed into clean cash. The sources of the money in actual are felony and the cash is invested in a approach that makes it look like clean cash and hide the identification of the prison a part of the cash earned.

Whereas executing the monetary transactions and establishing relationship with the brand new clients or maintaining existing customers the duty of adopting satisfactory measures lie on every one who is part of the organization. The identification of such component to start with is simple to deal with as a substitute realizing and encountering such situations later on within the transaction stage. The central bank in any country gives full guides to AML and CFT to combat such actions. These polices when adopted and exercised by banks religiously provide sufficient security to the banks to deter such conditions.

The purpose of laundering is to enable the money to be used legally. The purposes of money-laundering or terrorist financing often referred to as the fourth AML CFT directive IMF national risk assessment methodology on anti-money-laundering and countering the financing of terrorism 2013 Furthermore the experience of existing terrorist financing risk assessments was used including the following.

Reverse Money Laundering Aml Cft

Compared to similar activities of organized crime terrorist financing involves reverse money laundering.

Terrorist financing is often referred to as "reverse money laundering.. Those required for dealing with money laundering. MONEY LAUNDERING AND TERRORISM FINANCING. Once described as money laundering in reverse with a staged process generation aggregation transfer end use ascribed to it.

The term terrorism financing includes the financing of terrorist acts and of terrorists and terrorist organisations. It is usually perpetrated for the purpose of financing terrorism but can be also used by criminal organisations that have invested in legal businesses and would like to withdraw legitimate funds from official circulation. AML Financial Crime Money Laundering.

The Money Laundering and Financing of Terrorism Guidelines shall now be. As such it has sometimes been called reverse money laundering a process through. As with other types of financial crime terrorist financing continues to evolve.

Terrorist financing is also often referred to as reverse money laundering as it focuses on utilising legal assets to carry out terrorist activities which are often in the form of clean sources such as charitable organisations and legitimate business organisations. Underground banking Money laundering Black market of foreign techniques in placement currency layering and integration phases Source. This will often be done by a.

The Financial Action Task Force FATF is an independent inter-governmental body that develops and promotes policies to protect the global financial system against money laundering terrorist financing and the financing of proliferation of weapons of mass destruction. Money Laundering Financing of. The Money Laundering and Financing of Terrorism Guidelines which may be referred to herein as the MLFTG or MLFTG are hereby amended as follows.

As with money laundering terrorist financing is not that simplistic. D eveloping terrorist financing typologies for anti-money laundering AML programs requires understanding. Money laundering is the processing of criminal profits to disguise their illegal origin.

Unger 2007 laundering and terrorism financing population as a whole or represent all of the techniques that may be employed by money launderers or terrorism financers to conceal their funds or activity. AN OVERVIEW Jean-François Thony1 The purpose of this overview is to examine why and how criminal and terrorists organizations use legitimate financial institutions to move and store assets and how lawmakers have built on that fact to propose innovative and more efficient responses to crime problems. On the other hand money laundering always involves the proceeds of illegal activity.

One of the principal differences between criminal money laundering and terrorist financing is that the latter often involves smaller sums of money coming from sources that may be legitimate at the outset. You must understand the terrorist threat environment emerging terrorist trends the funding flows terrorists rely on to sustain their operations and your institutional risk for being used to facilitate terrorist funding flows. In some ways terrorist financing is the reverse of money laundering as quite often small sums of legitimate proceeds are pooled and put to use for.

This is a consequence of some fundamental differences between terrorism and organized crime which also lead to different implications in terms of. Terrorist financing involves the supply of funds to terrorist organisations very often with a cross-border dimension. Once these risks are properly understood countries will be able to implement anti-money laundering and counter terrorist financing measures that mitigate.

To enjoy their ill-gotten gains criminals commonly seek to disguise the illegal source of those profits. Terrorist financing uses funds for an illegal political purpose but the money is not necessarily derived from illicit proceeds. One of the key requirements of the FATF Recommendations is for countries to identify assess and understand the money laundering ML and terrorist financing TF risks that they are exposed to.

Reverse money laundering is a process that disguises a legitimate source of funds that are to be used for illegal purposes.

Anti Money Laundering And Counter Terrorism Financing

Http Seajbel Com Wp Content Uploads 2014 12 Law 38 Put Down The Financing Of Terrorism Reverse Money Laundering Pdf

International Banking Wealth Management Aml Quality Control Effective Anti Money Laundering Prezentaciya Onlajn

International Banking Wealth Management Aml Quality Control Effective Anti Money Laundering Prezentaciya Onlajn

Money Laundering And Blockchain Technology Conference For Finance

International Banking Wealth Management Aml Quality Control Effective Anti Money Laundering Prezentaciya Onlajn

Anti Money Laundering And Counter Terrorism Financing

Anti Money Laundering And Counter Terrorism Financing

Anti Money Laundering And Counter Terrorism Financing

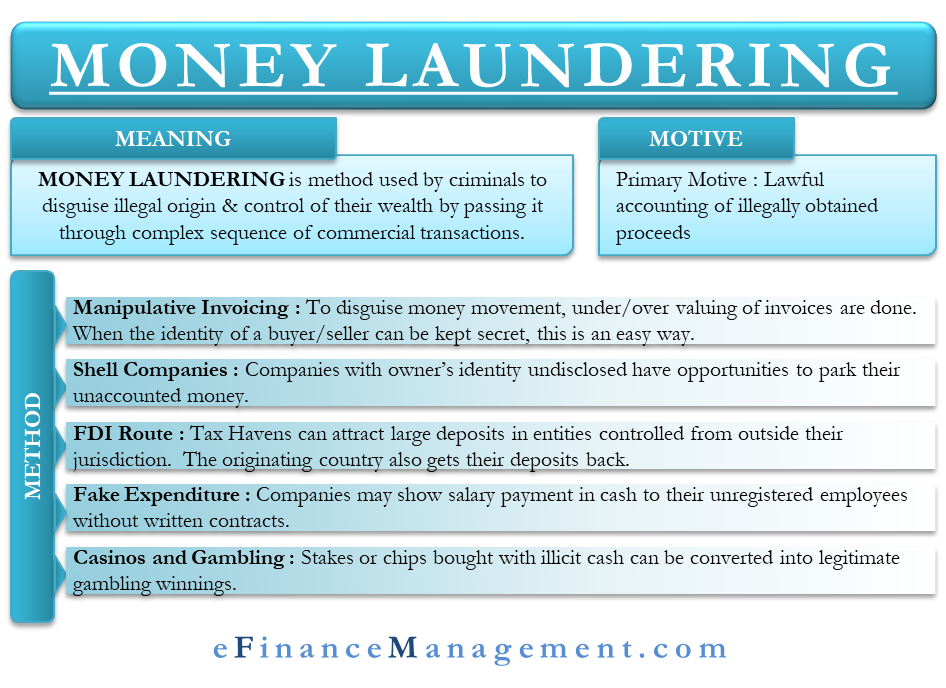

Money Laundering Define Motive Methods Danger Magnitude Control

Anti Money Laundering And Counter Terrorism Financing

What Is Reverse Money Laundering Deltanet

International Banking Wealth Management Aml Quality Control Effective Anti Money Laundering Prezentaciya Onlajn

The world of laws can seem to be a bowl of alphabet soup at times. US cash laundering laws are not any exception. We have now compiled a listing of the top ten cash laundering acronyms and their definitions. TMP Danger is consulting firm targeted on defending monetary services by decreasing threat, fraud and losses. We have now huge financial institution expertise in operational and regulatory threat. We've a powerful background in program management, regulatory and operational danger as well as Lean Six Sigma and Enterprise Process Outsourcing.

Thus money laundering brings many adverse penalties to the organization as a result of dangers it presents. It will increase the probability of major risks and the opportunity price of the bank and ultimately causes the bank to face losses.

Komentar

Posting Komentar